45+ how much should a mortgage be of your income

Ideally that means your monthly. Ad Easier Qualification And Low Rates With Government Backed Security.

How Much House Can I Afford The Motley Fool

Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process.

. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web 50 of your income. Ad Use Our Comparison Site Find Out Which Hpuse Loan Suits You The Best.

Web The amount of a mortgage you can afford based on your salary often comes down to a rule of thumb. For example some experts say you should spend no more. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Lock In Your Low Rate Today. Apply Online Get Pre-Approved Today. Ad Compare Best Mortgage Lenders 2023.

Ad Calculate and See How Much You Can Afford. Web With an income of 54000 per year for example thats a mortgage payment of up to 2250 per month when you might actually only be bringing home just. Necessities are the expenses you cant avoid.

Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income. To determine your front-end ratio multiply your annual income by 028 then divide that total by 12 for. Web Lenders use your debt-to-income ratio DTI as a measure of affordability.

The traditional 3545 model says that you. This portion of your budget should cover required costs such as. Save Time Money.

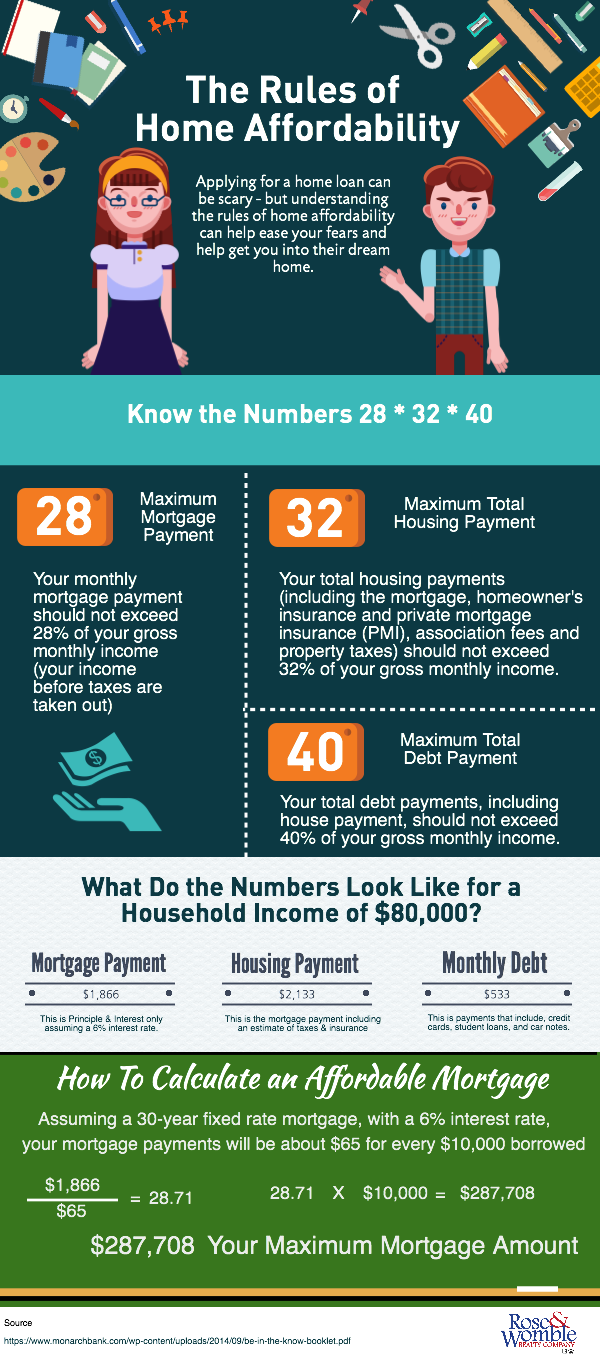

Web 28 rule The 28 percent rule which specifies that no more than 28 percent of your gross income should be spent on your monthly mortgage payment is a. Web One way to decide how much of your income should go toward your mortgage is to use the 2836 rule. It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan.

Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Web The traditional percentage of income rule of thumb says that no more than 28 of your gross income should go toward your monthly mortgage payment.

Web With the 35 45 model your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income or 45 more than your after-tax. However that maximum can go up to 45 percent. Are You Eligible For The VA Loan.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Ad If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Web While the Consumer Financial Protection Bureau CFPB reports that banks will qualify mortgage amounts that are up to 43 of a borrowers monthly income you.

Start By Checking The Requirements. Web This rule says you shouldnt spend more than 35 of your pre-tax income or 45 of your after-tax income on your total monthly debt which includes your mortgage. Web For example Fannie Mae requires that a borrowers DTI cant exceed 36 percent of their stable monthly income.

Ad Easier Qualification And Low Rates With Government Backed Security. Web Typically lenders cap the mortgage at 28 percent of your monthly income. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

And they see a 28 DTI as an excellent one. Get Instantly Matched With Your Ideal Housing Loan. Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most.

What Percentage Of My Income Should Go To Mortgage Forbes Advisor

Business Spotlight Einfach Besser Business Englisch Ausgabe 11 2022

Pineapple 354

Investing As We Age Research Reports Gerezmieuxvotreargent Ca

Private Money Lender Credibility Packet

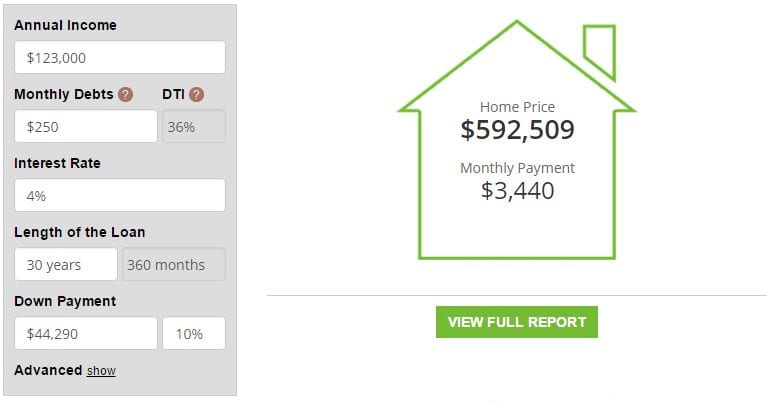

Mortgage Calculator Enter Your Income See Your Home Price Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Buy Young Earn More Buying A House Before Age 35 Gives Homeowners More Bang For Their Buck Urban Institute

What Percentage Of Your Income To Spend On A Mortgage

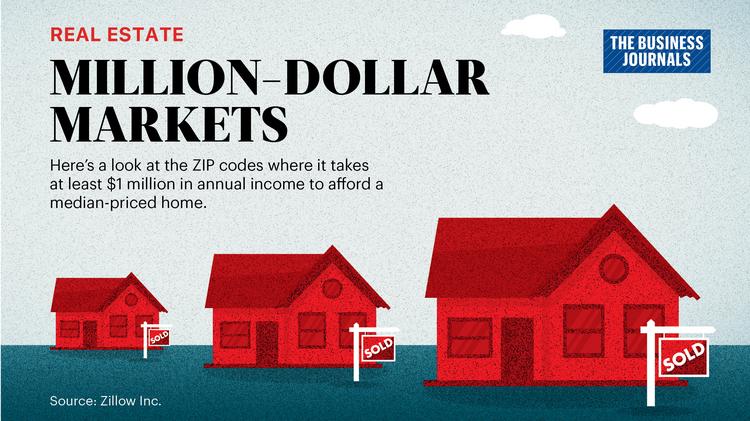

Beverly Hills 90210 And The 17 Other Zip Codes Where You Need To Earn 1m A Year To Buy A Home The Business Journals

Mortgage School The Rules Of Home Affordability Rose Womble Realty Co

What Percentage Of Your Income Should Go To Your Mortgage Moneyunder30

Will I Be Comfortable With A 550k House With A Salary Of 68k R Realestate

American Express Platinum Review 2023 Forbes Advisor

How Much Can I Afford To Borrow For A Mortgage Homeowners Alliance

How To Apply For The German Freelance Visa All About Berlin

The Struggle Is Real Finding Ways To Afford Where You Live Apartmentguide Com

A Cluster Of Modest Accounts What Kiwisaver Balances Really Look Like Good Returns